THX.V $

THX.L

Thor Explorations Announces Updated Mineral Resource Estimate At The Douta Gold Project, Senegal

March 20, 2023

NOT FOR DISSEMINATION IN THE UNITED STATES OR FOR

DISTRIBUTION TO U.S. WIRE SERVICES

Thor Explorations Ltd. (TSX VENTURE/AIM: THX) (“Thor” or the “Company”) is pleased to announce the results of an updated Mineral Resource Estimate (the "Douta Resource" or “2023 MRE”) prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") for the Douta Gold Project in Senegal.

Highlights

- Total Douta Resource of approximately 1.78 million ounces (“Moz”) of gold (“Au”), an increase of 144% in total resource as compared with the 2022 maiden mineral resource estimate declared for Douta in November 2021.

- Douta Resource constrained within optimised pit shells and comprised of:

- an initial Indicated Mineral Resource of 20.2 million tonnes (“Mt") grading 1.3 grammes per tonne (“g/t”) Au for 874,900 oz Au; and

- Inferred Mineral Resource of 24.1 Mt grading 1.2 g/t Au for 909,400 oz Au

- 2023 MRE supported by a total of 64,567 metres of drilling

- Updated Douta Resource encompasses the Makosa, Makosa Tail and the recently discovered Sambara prospects, all of which remain open along strike and down dip

- Drilling is ongoing on the above prospects with a further 40,000 metre drilling program to be completed in 2023 consisting of diamond drilling and reverse circulation drilling. Mineralisation remains open along strike between the known prospects with further growth potential along 20 kilometres of under-explored prospective strike length covered by the Douta exploration permit

Segun Lawson, President & CEO, stated

“This is an excellent milestone in the progress of the Douta Project. The 2023 MRE has more than doubled the contained gold within the Douta permit to over 1.7 million ounces, with the indicated component of the resource alone exceeding 870,000 ounces of gold compared to the maiden inferred resource of 730,000 ounces. In addition, there are a further 909,000 ounces of inferred resources within the optimised pit shells that we intend to convert to indicated classification with additional infill drilling which forms part of our ongoing 40,000 metre program. This updated resource base provides for a solid foundation for more advanced studies on the pathway to developing Thor’s second operating gold mine in West Africa.

“We are now focussing our exploration efforts towards expanding the resource along the prospective corridor that runs along the full 30km length of our exploration licence. Priority will be given to extensional drilling at Makosa, Maka, Mansa and the newly discovered Sambara prospects.

Introduction

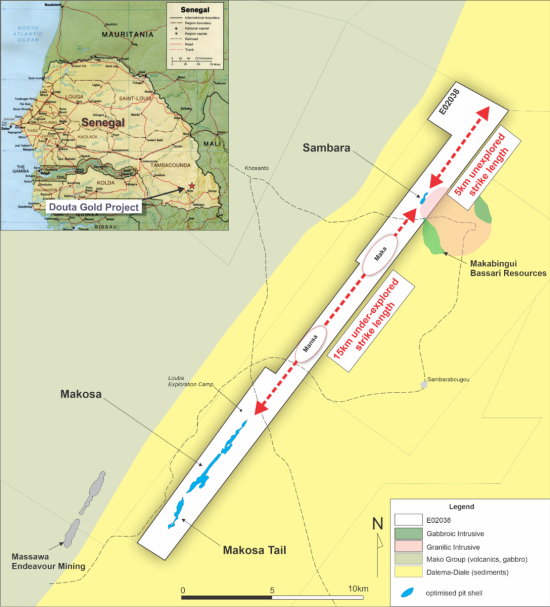

The Douta Gold Project is located within the Kéniéba inlier, in eastern Senegal and comprises the northeast trending gold exploration permit, E02038 that covers an area of 58 square kilometres (“km2”). Thor, through its wholly owned subsidiary African Star Resources Incorporated (“African Star”), has a 70% economic interest in partnership with the permit holder International Mining Company SARL (“IMC”). IMC has a 30% free carried interest in its development until the announcement by Thor of a Probable Reserve.

The Douta licence is strategically positioned 4km east of the deposits Massawa North and Massawa Central deposits which form part of the world class Sabadola-Massawa Project that is owned by Endeavour Mining (Figure 1). The Makabingui deposit, belonging to Bassari Resources Ltd, is located immediately to the east of the northern portion of E02038.

Summary of the 2023 MRE

The 2023 MRE encompasses the Makosa, Makosa Tail and Sambara zones, which are collectively named the Douta Resource.

The MRE has been estimated by an independent consultant and is reported at a cut-off grade of 0.5 g/t Au within optimised shells using a gold price of US$2,000.

| Classification | Tonnes (Mt) | Grade (g/t Au) | Contained Gold (k ounces) | Thor Interest |

| Indicated | 21.2 | 1.3 | 875 | 70% |

| Inferred | 24.1 | 1.2 | 909 | 70% |

Table 1: Douta Gold Project Total Classified Mineral Resource Estimate Summary, March 2023 (reported at cut-off grade of 0.5 g/t Au)

- Open Pit Mineral Resources are reported in situ at a cut-off grade of 0.50 g/t Au. An optimised Whittle shell (US$2,000) was used to constrain the resources.

- The Mineral Resource is considered to have reasonable prospects for economic extraction by open pit mining methods above a 0.50 g/t Au and within an optimised pit shell.

- Cut-off grade varied from 0.45 g/t to 0.48 g/t in a pit shell based on mining costs, metallurgical recovery, milling costs and G&A costs.

- Resource is reported as in-situ and no metallurgical or mining recovery factors have been applied.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Totals may not add exactly due to rounding.

- The statement used the terminology, definitions and guidelines given in the CIM Standards on Mineral resources and Mineral Reserves (May 2014) as required by NI 43-101.

- Bulk density is assigned according to weathering profile with a weighted average of 2.78.

- The resource estimate was prepared by Mr Kevin Selingue, Principal Geologist of MineralMind, Australia in accordance with NI 43-101. Mr Selingue is an independent qualified person ("QP") as defined by NI 43-101.

Mineral Resource Estimate

The MRE, as detailed in Table 2, has been estimated by an independent consultant and is reported at a cut-off grade of 0.5 g/t Au within optimised shells using a gold price of US$2,000.

| Area | Classification | Tonnes | Grade (g/t Au) | Contained Gold (ounces) | Thor Interest |

| Makosa | Indicated | 15,210,000 | 1.22 | 598,000 | 70% |

| Makosa | Inferred | 18,490,000 | 1.10 | 654,600 | 70% |

| Makosa Tail | Indicated | 4,610,000 | 1.73 | 256,800 | 70% |

| Makosa Tail | Inferred | 3,170,000 | 1.68 | 171,300 | 70% |

| Sambara | Indicated | 360,000 | 1.75 | 20,100 | 70% |

| Sambara | Inferred | 2,427,000 | 1.07 | 83,500 | 70% |

| Total | Indicated | 20,180,000 | 1.34 | 874,900 | 70% |

| Total | Inferred | 24,090,000 | 1.17 | 909,400 | 70% |

Table 2: Douta Gold Project Mineral Resource Estimate by Area, March 2023

(reported at cut-off grade of 0.5 g/t Au)

- Open Pit Mineral Resources are reported in situ at a cut-off grade of 0.50 g/t Au. An optimised Whittle shell (US$2,000) was used to constrain the resources.

- The Mineral Resource is considered to have reasonable prospects for economic extraction by open pit mining methods above a 0.50 g/t Au and within an optimised pit shell.

- Cut-off grade varied from 0.45 g/t to 0.48 g/t in a pit shell based on mining costs, metallurgical recovery, milling costs and G&A costs

- Metallurgical and mining recovery factors not applied.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Totals may not add exactly due to rounding.

- The statement used the terminology, definitions and guidelines given in the CIM Standards on Mineral resources and Mineral Reserves (May 2014) as required by NI 43-101.

- Bulk density is assigned according to weathering profile with a weighted average of 2.78.

- The resource estimate was prepared by Mr Kevin Selingue, Principal Geologist of MineralMind, Australia in accordance with NI 43-101. Mr Selingue is an independent qualified person ("QP") as defined by NI 43-101.

Drilling

The MRE is based on data obtained from a total of 64,567m of drilling consisting of 1,937m of diamond drilling and 62,630m of Reverse Circulation (“RC”) drilling which have been used to generate the updated MRE. RC drilling was carried out by Sengold (2020-2023), while historic diamond drilling was carried out by International Drilling Company (2017), Sendrill Consulting (2018) and ADS (2012).

Sample Analysis and Database

Drilling has been almost exclusively sampled on 1m intervals with the primary laboratory for analysis being ALS Global’s laboratory in Bamako, Mali. Split samples ranging in weight from 0.5 kilograms (“kg”) to 3.5kg, with an average of 2.3kg were collected for analysis. After the sample preparation a fire assay with an atomic absorption finish on a 50 grammes (“g”) subsample of the pulp (AA26), was completed. Umpire samples were submitted to the MSA laboratory in Abidjan.

Standard QA/QC protocols were followed with inserts of certified standards, blanks and duplicates representing approximately 10% of all analyses.

The Company’s database is maintained internally with independent audits carried out by Cube Consulting (Perth) on request.

Figure 1: Douta Project Location Map

Estimation Parameters

A four-pass Inverse Distance grade estimation was carried out within hard geological boundaries defined by a numerical models based on a nominal modelling grade cut off of 0.65 g/t Au. Ordinary Kriging has been used to validate the Inverse Distance estimation results.

Separate numerical models, using a 0.65 g/t Au cut off were generated for Makosa Tail, Makosa North and East and Sambara.

A weathering model was developed so bulk densities could be assigned according to weathering state.

The tonnage factor in the block models was based on 188 bulk density measurements and determined by assigning the averaged bulk densities to the following material types:

- 2.76 t/m3 for Fresh (FRS),

- 2.70 t/m3 for weakly oxidized (WOX),

- 2.60 t/m3 for moderately oxidized (MOX), and

- 2.50 t/m3 for strongly oxidized (SOX).

At this stage of the project, it is appropriate that blocks within the Makosa mineralised zones have the same average bulk densities as the blocks within the Makosa waste zones.

Exploratory Data Analysis and Top Cut Selection

Prior to selecting the composite length, the average sample length was determined. The majority (91%) of the samples are 1.0m long, thus a 1m composite length was adopted.

Statistical analysis was completed on assay values composited to 1m and extracted from within the mineralised zone domains for the two prospect areas, with a top cut (cap) being selected to reduce the influence of any ‘outlier’ high grades.

Globally, a total of 4,594 composites were included in the database for top capping analysis. At Makosa Main, nine (9) composite gold values that exceeded 15 g/t were reduced to 15 g/t. At Makosa Tail, eleven (11) composite gold values that exceeded 15 g/t were reduced to 15g /t. At Sambara, two (2) composite gold values that exceeded 15 g/t were reduced to 15 g/t. Gold composite values below were unchanged. The effect of the application of the top cuts is summarised in Table 3.

At Makosa, the top capping reduced the average mean grade from 1.29 g/t Au to 1.23 g/t Au. At Makosa Tail, the top capping reduced the average mean grade from 1.69 g/t Au to 1.57 g/t Au. At Sambara, the top capping reduced the average mean grade from 1.9 g/t Au to 1.81 g/t Au.

| Domain | No of Composites | Maximum Au (g/t) | Mean Au (g/t) | Top Cut Au (g/t) | Capped Mean Au (g/t) | No of Composites affected | % Metal |

| Makosa | 3,346 | 54.5 | 1.29 | 15 | 1.23 | 9 | -5% |

| Makosa Tail | 1,079 | 36.18 | 1.69 | 15 | 1.57 | 11 | -7% |

| Sambara | 169 | 21.12 | 1.90 | 15 | 1.81 | 2 | -5% |

| Total | 4,594 | 54.5 | 1.74 | 1.62 | 22 | -5% |

Table 3: Composite statistics and effect of top cut on contained metal

Estimation Methodology

Variography was carried out on each combined domain with the appropriate parameters used to estimate the gold grade using Inverse Distance (ID). Due to the difference in orientation between Makosa Tail, Makosa/Makosa North and Sambara three separate block models were created to better align blocks with the orientation of the lode systems.

Block estimation used a five-pass strategy with the number of required samples with 1 to 5 for pass 1, 2 to 10 for pass 2, 2 to 20 for pass 3, 4 and 5, and search distance increased for each estimation pass.

Classification

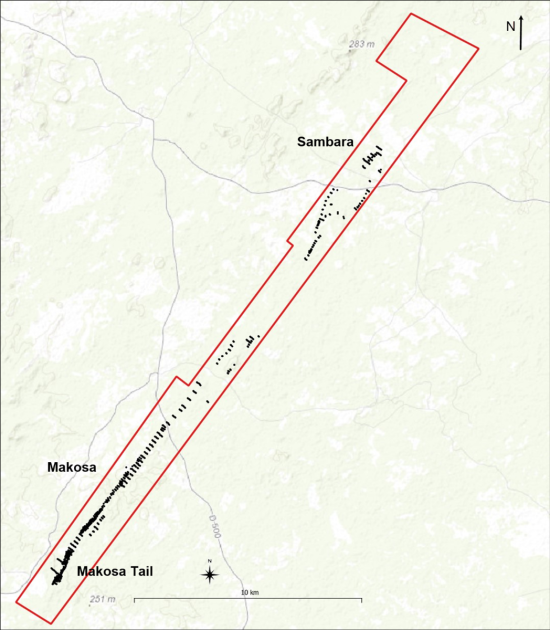

Drill hole density ranges from 50m to 200m spaced sections with spacing between holes on-section typically 30m (Figure 2).

The sample population within the 0.2 g/t grade shell indicates a good grade continuity, superior to most orogenic gold deposits.

Classification is based on parameters extracted from the sample variograms.

The classification as 49% indicated and 51% inferred is considered appropriate for the current level of understanding and development of the Mineral Resource.

Mineral Resource Constraints

To test the reasonable prospects for eventual economic extraction, the 2023 MRE is constrained by an optimised pit shell (revenue factor of 1) defined by the parameters shown in Table 4.

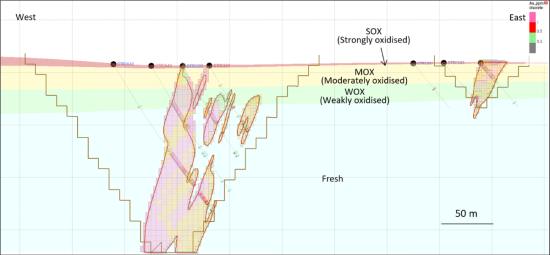

A cross-section showing the pit shell in relation to the mineral resource at Makosa Tail is illustrated in Figure 3.

| Parameter | Unit | ||

| SOX | Strongly oxidised: 4% of the resource | 45 | degrees |

| MOX | Medium oxidised: 6% of the resource | 45 | degrees |

| WOX | Weakly oxidised: 4% of the resource | 50 | degrees |

| Fresh | Fresh Rock and sulphides: 86% of the resource | 58 | degrees |

| Mining Cost | |||

| - Load and Haul | US$1.2/t @ surface, increase $0.1/t per 5m bench | 1.2 | $/t |

| D&B - SOX | 2.60 Total cost $/t | 2.6 | $/t |

| D&B - MOX/WOX | 3.10 Total cost $/t | 3.1 | $/t |

| D&B - Fresh | 4.00 Total cost $/t | 4 | $/t |

| Total | |||

| Mining Recovery | 95 | % | |

| Mining Dilution | 5 | % | |

| Processing Cost | |||

| - Variable Cost | power, reagents, consumables, direct labour costs | 16 | $/t ore |

| - G&A + overheads | 5.5 | $/t ore | |

| - Grade Control | blast hole sampling/gc program | 0.5 | $/t ore |

| - Ore Mining | Included in Mining Cost | $/t ore | |

| Total | 22 | $/t | |

| Process Recovery | |||

| SOX | 90 | % | |

| MOX | 90 | % | |

| WOX | 90 | % | |

| Fresh | 88 | % | |

| Product Sell Price | Multiple gold prices to be run | $2,000 | US$/oz |

| Sell Price | $64.30 | gram | |

| Discount Rate | 8 | % | |

| Mill Limit | 2.5 | Mill Mt/pa |

Table 4: Open Pit Optimisation Parameters

Metallurgical Factors

Thor has submitted metallurgical samples to ALS (Perth) and preliminary recovery results indicate that oxide material may be recovered by normal gravity/CIL methods whereas the fresh material is refractory to partially refractory and may be recovered by either Biological Oxidation (BIOX) or Pressure Oxidation (POX) methods. Ongoing metallurgical test work is focussed on achieving the optimal operational flow sheet for the fresh material.

The initial metallurgical results at Makosa are comparable to those reported from initial test work at the Massawa deposit which is located 4km to the west and which is owned by Endeavour Mining. Following exhaustive metallurgical testing the optimal laboratory flow sheet for Massawa achieved recoveries of 88% for fresh (refractory to partially refractory) using a BIOX processing route and 90% for oxide to transitional.

Until a representative number of samples has been fully tested using optimal recovery techniques Thor has adopted similar recovery factors used at Massawa.

This is considered appropriate for the current level of classification and understanding of the Mineral Resource.

Figure 2: Drillhole Location Plan

Figure 3: Cross Section through Makosa Tail

Environmental Factors

No impediments with respect to reserves, parks or other areas of significance have been identified on the project area. The Douta exploration licence consists of a modified environment as a result of human activities including harvesting forest flora and burning vegetation as part of sporadic and unregulated historic artisanal mining activity. There are no settlements within the licence boundary.

Thor abide by the Senegal 2016 Mining Code which introduced an obligation for mining title holders to contribute annually to a local development fund in the amount of 0.5% of sales, minus annual fees. Under the 2016 Code, mining projects require a prior environmental impact assessment, to be approved by the Directorate of the Environment and Classified Establishments.

Initial environmental baseline information within the Douta exploration licence has included both dry and wet season ecology surveys that were carried out in May 2021 and November 2022 by Senegal-based Synergie Afrique. Further ground and surface water quality monitoring has commenced within the exploration permit in November 2022 and will continue with quarterly monitoring. The surveys will form part of the overall Environment and Social Impact Assessment (“ESIA”) which is expected to be completed within 12 months.

Ongoing Exploration

Thor intends to progress the Makosa Resource expansion drilling together with parallel workstreams including detailed metallurgical sampling and testing, environmental and social baseline monitoring as part of an Environmental and Social Impact Assessment, geotechnical and hydrological studies.

The main resource expansion priorities are:

- Infill and resource definition drilling to convert inferred to indicated classification.

- Continued drilling to increase the overall resource base through extensional drilling along the prospective corridor.

About Thor

Thor Explorations Ltd. is a Canadian, West African focussed mineral gold producer listed on both the TSX Venture Exchange (TSX-V:THX) and AIM Market of the London Stock Exchange (AIM:THX). Thor produced 98,000 ounces from its 100% owned Segilola Gold Mine located in Osun State of Nigeria and a 70% interest in the Douta Gold Project located in south-eastern Senegal. Thor trades on the TSX Venture Exchange under the symbol “THX”.

THOR EXPLORATIONS LTD.

Segun Lawson

President & CEO

Qualified Person

The above information relating to the resource estimate has been prepared by Mr Kevin Selingue, Principal Geologist of MineralMind, Australia in accordance with NI 43-101, and is responsible for this MRE. Mr Selingue is an independent qualified person ("QP") as defined by NI 43-101 and is a qualified person under the AIM Rules and has reviewed and approves the content of this news release.

The information relating to exploration results has been prepared under the supervision of Alfred Gillman (Fellow AusIMM, CP), who is designated as a “qualified person” under National Instrument 43-101 and the AIM Rules and has reviewed and approves the content of this news release. He has also reviewed QA/QC, sampling, analytical and test data underlying the information.

This announcement contains inside information for the purposes of Article 7 of Regulation (EU) 596/2014.

For further information please contact:

Thor Explorations Ltd

Email: moc.lpxeroht@ofni

Canaccord Genuity (Nominated Adviser & Broker)

Henry Fitzgerald-O’Connor / James Asensio / Thomas Diehl

Tel: +44 (0) 20 7523 8000

Hannam & Partners (Broker)

Andrew Chubb / Matt Hasson / Nilesh Patel / Franck Nganou

Tel: +44 (0) 20 7907 8500

Fig House Communications (Investor Relations)

Tel: +1 416 822 6483

Email: moc.lpxeroht@snoitaler.rotsevni

Ibu Lawson (Investor Relations)

e-mail: moc.lpxeroht@noswal.ubi

Mobile : +44 7909 825 446

BlytheRay(Financial PR)

Tim Blythe / Megan Ray / Said Izagaren

Tel: +44 207 138 3203

| Unit | Definition |

| g | Grammes |

| g/t | Grammes per tonne |

| km | Kilometre (1,000 m) |

| km2 | Square kilometres |

| koz | Kilo ounces (1,000 oz) |

| kt | Kilotonnes (1,000 t) |

| m | Metre |

| m2 | Square metres |

| m3 | Cubic metres |

| Moz | Million ounces (1,000,000 oz) |

| Mt | Million tonnes (1,000,000 t) |

| Mtpa | Million tonnes per annum |

| oz | Troy Ounces |

| t | Tonne |

| t/m³ | Tonnes per cubic meter |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release does not constitute an offer to purchase securities. The securities to be offered in the offering have not been and will not be registered under the United States Securities Act of 1933, as amended, or any state securities laws and may not be offered or sold in the United States or to, or for the benefit or account of, a U.S. person, except pursuant to an available exemption from such registration requirements.

Cautionary Note Regarding Forward-Looking Statements

Except for the statements of historical fact contained herein, the information presented constitutes “forward looking statements” within the meaning of certain securities laws, and is subject to important risks, uncertainties and assumptions that could cause the actual results of the Company to differ materially form the forward-looking statements. Such forward-looking statements, including but not limited to, the Company’s ability to fully finance the Project, to bring the Project into operation or to produce gold from the Project, and the use of the proceeds. The words “may”, “could”, “should”, “would”, “suspect”, “outlook”, “believe”, “anticipate”, “estimate”, “expect”, “intend”, “plan”, “target” and similar words and expressions are used to identify forward-looking information. The forward-looking information in this news release describes the Company’s expectations as of the date of this news release and accordingly, is subject to change after such date. Readers should not place undue importance on forward-looking information and should not rely upon this information as of any other date.While the Company may elect to, it does not undertake to update this information at any particular time.

Glossary of Technical Terms:

"Au" the chemical symbol for gold;

"cut-off grade" The lowest grade, or quality, of mineralised material that qualifies as economically mineable and available in a given deposit. May be defined on the basis of economic evaluation, or on physical or chemical attributes that define an acceptable product specification;

"g/t" grams per tonne;

"Indicated resource" a part of a mineral resource for which tonnage, densities, shape, physical characteristics, grade and mineral content can be estimated with a reasonable level of confidence. It is based on exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes. The locations are too widely or inappropriately spaced to confirm geological and/or grade continuity but are spaced closely enough for continuity to be assumed;

"Inferred resource" a part of a mineral resource for which tonnage, grade and mineral content can be estimated with a low level of confidence. It is inferred from geological evidence and has assumed, but not verified, geological and/or grade continuity. It is based on information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that may be limited or of uncertain quality and reliability;

"Inverse Distance Squared" a conventional mathematical method used to calculate mineral resources. Near sample points provide a greater weighting than samples further away for any given resource block;

"m" Metres;

"oz" Ounces;

“t” Tonnes;

"optimised pit shell"; Is generated by computer software that uses the Lerch-Grossman algorithm, which is a 3-D algorithm that can be applied to the optimisation of open-pit mine designs. The purpose of optimisation is to produce the most cost effective and most profitable open-pit design from a resource block model.