THX.V $

THX.L

Financial And Operating Results For The Three And Nine Months Ending September 30, 2023

November 27, 2023

Focus on drilling regional Segilola gold targets, continuation of lithium prospects

Thor Explorations Ltd. (TSXV / AIM: THX) ("Thor Explorations", "Thor" or the "Company") is pleased to provide an operational and financial review for its Segilola Gold mine, located in Nigeria ("Segilola"), and for the Company's mineral exploration properties located in Nigeria and Senegal for three ("Q3 2023" or the "Period") and nine months to September 30, 2023.

Financial Highlights of Q3 2023 and nine months to Sept 2023

US$ | Q3 2023 | Q3 2022 | Nine months to Sept 2023 | Nine months to Sept 2022 |

|---|---|---|---|---|

Revenue | $36.6m | $55.7m | $118.2m | $121.9m |

AISC* | $1392/oz | $1378/oz | $1321/oz | $1273/oz |

Cash operating cost | $1193/oz | $1137/oz | $1005/oz | $991/oz |

EBITDA | $11.8m | $17.8m | $47.0m | $49.0m |

Net Profit | $2.3m | $7.6m | $14.5m | $17.8m |

Cash at end of period | $8.3m | $2.5m | - | |

Net Debt | $19.4m | $40.7m | - |

* all-in sustaining cost

Operational Highlights for Q3 2023

Gold production targets on track for FY23 guidance

- Gold production for the Period totalled 19,021 ounces ("oz")

- Nine months to Sept ’23 production of 63,328 oz - in line with expectations

- All main operating units of the process plant continue to perform well, with the main west wall push back completed

- Ongoing improvements at process plant being undertaken and to be commissioned in Q4 2023

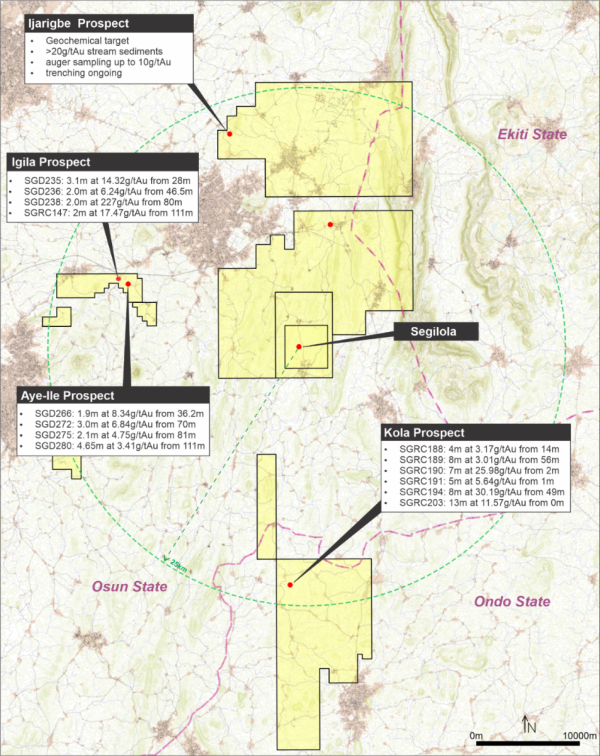

Focused exploration at Segilola

- Focus of gold exploration activities within a 25km radius from the Segilola operations

- Continuation of reverse circulation ("RC") drilling, stream sediment sampling and grid auger sampling at the Kola Prospect, 23km south of Segilola,

- Continuation of diamond drilling on identified high-grade quartz-vein style mineralisation at Aye-Ile prospect which is located 15km west of Segilola with several narrow high-grade intersections drilled

Ongoing Preliminary Feasibility Study Workstreams of Douta Project

- Further progress made with Pre-Feasibility Study ("PFS") workstreams with an expected completion for Q1 2024

- Environmental and Social Impact Assessment is ongoing

- Metallurgical test work is continuing at IMO Laboratory in Perth, Western Australia

- Compilation and reporting of geotechnical data

- Resource drilling, which targeted the higher-grade parts of the existing inferred resource has been completed

Thor Lithium Exploration at Oyo Project

- At Oyo Project Location 6 a total of 77 RC drillholes totalling 4,585 metres ("m") were drilled

- Significant intersections previously reported include 11m grading 1.53% lithium oxide ("Li2O"), 9m grading 2.42% Li2O and 11m grading 2.61% Li2O

- Regional soil geochemical surveys commenced

- Additional tenure obtained at both the Oyo and Ekiti Project Areas

- Reconnaissance mapping and sampling at the Ekiti Project returned positive results including a rock chip sample grading 2.92% Li2O with drilling now commence at this Project

ESG

- Two weather stations installed at Segilola to assist with accurate climate database and mine planning

- Continuous progression of livelihood restoration programmes to individuals affected locally within the Segilola mine footprint

- Community projects undertaken by Africa Star Resources team in Senegal, including improvements of local school toilet facilities, clearing wasteland at local cemetery and providing a generator for the local police station

Outlook

- FY 2023 production guidance of 85,000 oz of gold maintained

- AISC guidance for the year maintained at US$1,150 - US$1,350 per ounce

- H2 2023 drilling programs:

- Continuation of drilling at Segilola gold regional targets and underground project

- Continuation of drilling at Oyo lithium prospect and commencement of drilling at the Ekiti lithium prospects in Nigeria

- Completion of the Douta resource update in Q4 2023

- Continued assessment of prospective exploration properties in Nigeria

- Continued exploration programs across our exploration portfolio in Nigeria

Segun Lawson, CEO, commented:

“Our Q3 2023 gold production of 19,104oz is in-line with our August guidance update of 85,000oz for the full year 2023.We are pleased to have achieved this and to have completed the pushback of the west wall which means that the pit conditions have significantly improved. We are now well positioned to mine more flexibly and efficiently going forwards.

Our process plant continues to perform above design capacity. Upgrades to the process plant leaching and electrowinning circuits are being phased-in over Q4 2023 and Q1 2024, which are expected to result in a release of gold-in-circuit and increased plant recoveries from December 2023, continuing throughout 2024.

In terms of financial performance, whilst the lower grades have led to lower revenue and profits in the quarter, we have maintained good levels of positive cash flow. We anticipate a stronger financial performance in the final quarter as the mine grade increases.

The resource drilling at our Douta gold project in Senegal, which was targeting the higher-grade zones of the inferred resource, has been completed and final assays are pending. The Environmental and Social Impact Assessment is ongoing and metallurgical test work is continuing at IMO Laboratory in Perth, Western Australia. To maximise the full potential of the 1.78 Moz of gold resource at Douta, we are extending the metallurgical testwork program with IMO and will also be conducting further testwork with our engineering design partner JinPeng engineering in China to confirm equipment selection. It is important that we confirm a robust process design that maximises the overall economics of the project and that provides us with the confidence to progress directly to project implementation. We are therefore postponing the preparation of an updated resource for Douta until confirmation of the process design and thereafter release of the PFS, targeting Q1 2024.

We have made good early progress at our West Oyo Lithium Project in Nigeria, with an encouraging initial set of drilling results. We have been able to confirm and delineate lithium-bearing mineralisation, with spodumene confirmed as the primary lithium-bearing mineral. Our plan is to expand our drilling program to the other pegmatites across our permits and expect to receive further results in Q4 2023.”

The Group's Consolidated Condensed Interim Financial Statements together with the notes related thereto, as well as the Management's Discussion and Analysis for the three and nine months ended September 30, 2023, are available on Thor Explorations' website at https://thorexpl.com/investors/financials/.

About Thor Explorations

Thor Explorations Ltd. is a mineral exploration company engaged in the acquisition, exploration, development and production of mineral properties located in Nigeria, Senegal and Burkina Faso. Thor Explorations holds a 100% interest in the Segilola Gold Project located in Osun State, Nigeria and has a 70% economic interest in the Douta Gold Project located in south-eastern Senegal. Thor Explorations trades on AIM and the TSX Venture Exchange under the symbol "THX".

For further information please contact:

Thor Explorations Ltd

Email: moc.lpxeroht@ofni

Canaccord Genuity (Nominated Adviser & Broker)

Henry Fitzgerald-O'Connor / James Asensio / Harry Rees

Tel: +44 (0) 20 7523 8000

Hannam & Partners (Broker)

Andrew Chubb / Matt Hasson / Jay Ashfield / Franck Nganou

Tel: +44 (0) 20 7907 8500

Fig House Communications (Investor Relations)

Tel: +1 416 822 6483

Email: moc.lpxeroht@snoitaler.rotsevni

Yellow Jersey PR (Financial PR)

Charles Goodwin / Shivantha Thambirajah / Soraya Jackson

Tel: +44 (0) 20 3004 9512

BlytheRay (Financial PR)

Tim Blythe / Megan Ray / Said Izagaren

Tel: +44 207 138 3203

Qualified Person\

The technical information included in this report has been prepared under the supervision of Alfred Gillman (Fellow, AusIMM, CP Geology), who is designated as a "qualified person" under National Instrument 43-101 and AIM and has reviewed and approves the content of this news release. He has also reviewed QA/QC, sampling, analytical and test data underlying the information.

Production Metrics

Units | Q3 – 2023 | Q2 –2023 | Q1 - 2023 | Q4 - 2022 | Q3 - 2022 | Q2 - 2022 | Q1 - 2022 | ||

|---|---|---|---|---|---|---|---|---|---|

Mining | |||||||||

Total Mined | Tonnes | 5,673,193 | 5,633,688 | 4,194,689 | 4,296,494 | 4,018,431 | 4,031,584 | 3,759,524 | |

Waste Mined | Tonnes | 5,370,279 | 5,355,105 | 3,996,264 | 3,974,073 | 3,793,249 | 3,747,504 | 3,533,610 | |

Ore Mined | Tonnes | 302,915 | 278,583 | 198,425 | 322,421 | 225,182 | 284,079 | 226,314 | |

Grade | g/t Au | 2.44 | 2.43 | 2.85 | 3.51 | 4.43 | 3.63 | 2.68 | |

Daily Total Mining Rate | Tonnes/Day | 61,665 | 61,909 | 46,608 | 46,701 | 43,679 | 44,303 | 41,772 | |

Daily Ore Mining Rate | Tonnes/Day | 3,292 | 3,061 | 2,205 | 3,505 | 2,448 | 3,122 | 2,515 | |

Stockpile | |||||||||

Ore Stockpiled | Tonnes | 338,558 | 297,060 | 270,215 | 300,531 | 229,909 | 249,281 | 179,758 | |

Ore Stockpiled | g/t Au | 0.99 | 1.06 | 1.14 | 1.48 | 1.19 | 1.46 | 1.23 | |

Ore Stockpiled | Oz | 10,756 | 10,124 | 9,904 | 14,300 | 8,796 | 11,701 | 7,109 | |

Processing | |||||||||

Ore Processed | Tonnes | 261,671 | 255,231 | 231,001 | 254,824 | 241,434 | 211,582 | 221,900 | |

Grade | g/t Au | 2.46 | 2.99 | 2.95 | 3.38 | 3.58 | 3.66 | 3.18 | |

Recovery | % | 92.3 | 94 | 94.1 | 95 | 95.5 | 95.5 | 94.1 | |

Gold Recovered | Oz | 19,104 | 23,078 | 20,629 | 26,331 | 26,523 | 23,785 | 21,343 | |

Milling Throughput | Tonnes/Day | 2,844 | 2,805 | 2,567 | 2,770 | 2,624 | 2,325 | 2,466 | |

Key Exploration updates

Exploration Activity Summary Q3 2023

Segilola near mine exploration continued as a priority for the Group in 2023. The Group also completed its field exploration activities at the Douta Project in Senegal and is now completing various workstreams for the Douta Preliminary Feasibility Study.

The Group continued to expand its portfolio in Nigeria through the acquisition of additional pegmatite bearing lithium licences in various locations via entering into joint venture agreements with existing licence holders.

The majority of the exploration activities carried out on all the Group’s licences, consisted of Reverse Circulation drilling, Diamond Drilling, geochemical stream sediment sampling, auger drilling and soil sampling. Work continued on the Kola target which is located about 20km from the Segilola Mine following the significant geochemical signature and follow up drill results that included several anomalous zones.

In Senegal, the Group’s Douta Project encompasses a mineral resource of 1.78 million ounces (“Moz”) of gold (“Au”). Workstreams focussed on the proposed process flow sheet in support of a Preliminary Feasibility Study (PFS) commenced during the quarter following the completion of the resource drilling program.

As part of its strategy of identifying high-value mineral resource opportunities, Thor, through its fully owned subsidiary Newstar Minerals Ltd, continued to carry out drilling activities on its West Oyo Lithium project however the drilling program was interrupted due to heavy rains in Oyo, delaying the drill results to Q4 2023.

Exploration drilling statistics summary for the Period

Prospect | Target Commodity | Diamond | RC | Total | |||

|---|---|---|---|---|---|---|---|

No. Holes | Metres | No. Holes | Metres | No. Holes | Metres | ||

Western Prospect - Aye-ile | gold | 14 | 1,866 | 14 | 1,866 | ||

Southern Prospect -Kola | gold | 39 | 2,621 | 39 | 2,621 | ||

Newstar Lithium - Oyo | lithium | 77 | 4,585 | 77 | 4,585 | ||

Total | 14 | 1,866 | 116 | 7,206 | 130 | 9,072 | |

Nigeria Gold

Introduction

The high grade Segilola gold deposit is located on the major regional shear zone that extends for several hundred kilometres through the gold-bearing Ilesha schist belt (structural corridor) of Nigeria.

The key objective of the exploration strategy is to extend the life of mine (“LOM”) at Segilola. Approximately 80% of the Group’s Nigerian exploration effort is concentrated within a 25km radius from the Segilola operation such that potential gold-bearing material can be easily trucked to the existing plant. In parallel to this, the Group also continued to carry out generative exploration activities in areas that are further from the mine.

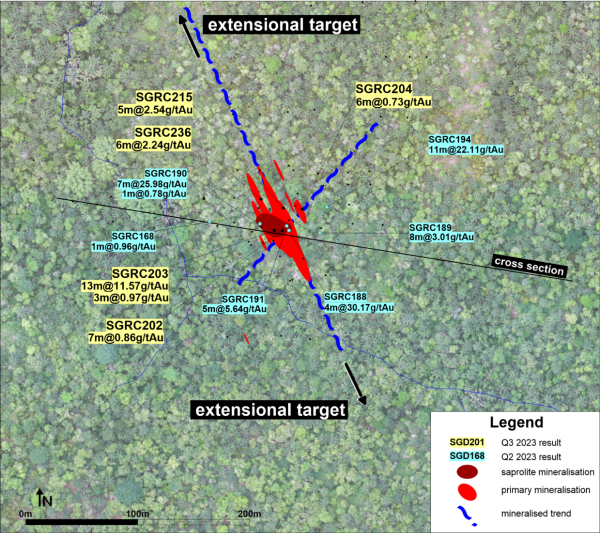

Segilola Southern Prospects

The southern prospects cover an area that is located to the south from the Segilola Gold Mine. Regional stream sediment sampling located an area of interest at what is now referred to as the Kola target. Kola is located about 20km from the Segilola Mine. Further follow up drill testing of this greenfield target intersected several high grade anomalous zones of interest including 13m grading 11.57g/tAu.

Further drilling at the Kola Target has delineated high grade mineralisation extensions to the north-west and the south-east as illustrated in Figure 2.2 below. Drilling is ongoing throughout Q4 2023 to test these extensional targets.

Figure 2.2 Segilola Southern Prospects

Kola Prospect Significant Results Q3 2024

Hole ID | x | Y | Z | Depth | Dip | Azimuth | From (m) | To (m) | Interval (m) | Grade (g/tAu) |

|---|---|---|---|---|---|---|---|---|---|---|

SGRC202 | 699920 | 807870 | 259 | 31 | -90 | 0 | 0 | 7 | 7 | 0.86 |

SGRC203 | 699913 | 807870 | 259 | 26 | -90 | 0 | 0 | 13 | 13 | 11.57 |

SGRC203 | 21 | 24 | 3 | 0.97 | ||||||

SGRC204 | 699938 | 807889 | 259 | 70 | -60 | 270 | 5 | 11 | 6 | 0.73 |

SGRC215 | 699921 | 807890 | 259 | 31 | -60 | 90 | 17 | 22 | 5 | 2.54 |

SGRC236 | 699901 | 807898 | 259 | 60 | -60 | 90 | 20 | 26 | 6 | 2.24 |

(0.5g/tAu lower cut off; maximum 1m internal dilution)

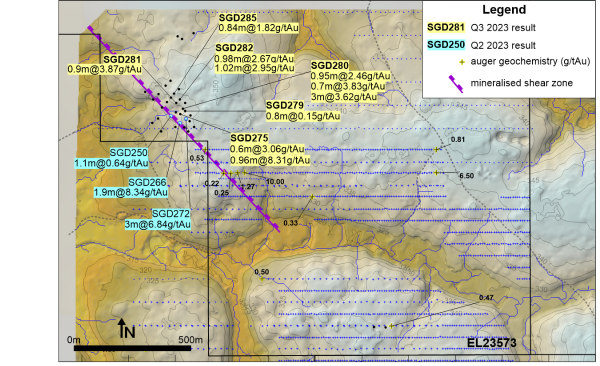

Segilola Western Prospects

The Western Prospects are located about 15km directly west from the Segilola Gold Mine and cover mostly amphibolitic rocks that contrast with the more gneissic terrain that is developed at Segilola itself. The prospect comprises several exploration permits that are held under exercised option agreements. The area is easily accessed through a series of sealed roads and gravel tracks. The Western Prospects are held under a joint venture agreement (“Thor-Esteedan JV”) between Thor’s wholly owned subsidiary Segilola Gold Limited (“SGL”) and a local mineral exploration company, Esteedan Limited (“Esteedan”).

Igila

Drilling continued at Igila following up on the series of narrow high grade mineralised lodes. Exploration activities at the Western Prospects was aimed at identifying additional strike length and identifying additional lodes such as the Aye-Ile prospect.

Aye-Ile

The Aye-Ile prospect is located approximately 1.2km along strike to the south-east from Igala. Drill testing of anomalous auger geochemistry located a north-east dipping vein-system that is developed on the same structural orientation as Igala. Additional drilling is planned to expand the zone of mineralisation and to infill the prospective strike between Igala and Aye-Ile. Further drilling intersections were drilled in the period with results highlighted in the table below.

Prospect | Hole ID | x | Y | Z | Depth | Dip | Azimuth | From (m) | To (m) | Interval (m) | Grade (g/tAu) |

|---|---|---|---|---|---|---|---|---|---|---|---|

Aye-Ile | SGD250 | 684182 | 836855 | 386 | 110 | -60 | 320 | 40.7 | 41.8 | 1.1 | 0.64 |

Aye-Ile | SGD266 | 684219 | 836824 | 376 | 84 | -60 | 320 | 36.2 | 38.1 | 1.9 | 8.34 |

Aye-Ile | SGD272 | 684246 | 836842 | 347 | 101 | -60 | 320 | 70 | 73 | 3 | 6.84 |

(0.5g/tAu lower cut off; maximum 1m internal dilution)

Aye- Ile exploration map

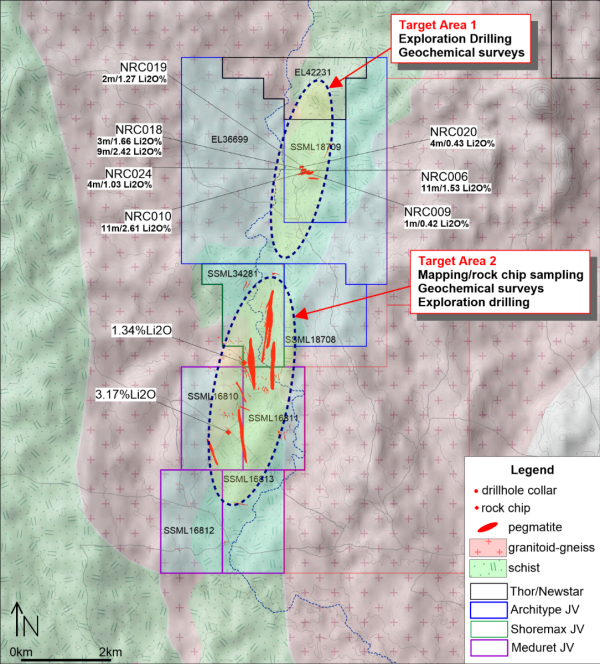

Newstar Lithium

Thor has secured over 600km2 of granted tenure in Nigeria that form Oyo State, Kwara State and Ekiti State Lithium Project Areas. The Oyo State Project Area encompasses what Thor considers to be one of Nigeria’s most significant lithium pegmatite occurrence which is currently being exploited by small-scale lithium mining. In the period, Thor has added further licences in Ekiti to its portfolio.

The Oyo State Lithium Project comprises approximately 38km2 of exploration tenure that is located towards the westernmost border of Nigeria and within 200km of the commercial capital of Lagos. The project area is unique in the Nigerian context as it is mostly located in a relatively sparsely populated region of the country but within close proximity to large population centres and advanced infrastructure such as road, rail and ports.

Target Area 1

Reconnaissance rock chip sampling carried out in 2022 in the western parts of Oyo State returned Li2O analyses of between 1.34% and 9.31%. Thor has secured tenure over this area in a number of joint venture agreements together with wholly owned exploration permits.

A program of reverse circulation targeted an identified pegmatite trend that is developed within northerly trending mafic sequence that is surrounded by granitoid-gneiss terrain.

The significant results from this program are listed below.

Hole ID | X | Y | Depth | Dip | Azimuth | From (m) | To (m) | Interval (m) | Grade (%Li2O) | True Width (m) |

|---|---|---|---|---|---|---|---|---|---|---|

NRC006 | 494432 | 899276 | 110 | -60 | 110 | 14 | 25 | 11 | 1.53 | 10.5 |

includes | 15 | 24 | 9 | 1.70 | 8.6 | |||||

NRC009 | 494530 | 899242 | 50 | -60 | 110 | 14 | 15 | 1 | 0.42 | 1.0 |

NRC010 | 494515 | 899248 | 60 | -60 | 290 | 15 | 26 | 11 | 2.61 | 10.5 |

NRC018 | 494450 | 899300 | 46 | -90 | 0 | 26 | 29 | 3 | 1.66 | 2.9 |

includes | 27 | 29 | 2 | 2.11 | 1.9 | |||||

35 | 44 | 9 | 2.42 | 8.6 | ||||||

NRC019 | 494445 | 899365 | 52 | -90 | 0 | 33 | 35 | 2 | 1.27 | 1.9 |

includes | 33 | 34 | 1 | 2.08 | 1.0 | |||||

NRC020 | 494396 | 899351 | 50 | -90 | 0 | 6 | 10 | 4 | 0.43 | 3.8 |

NRC024 | 494500 | 899300 | 50 | -90 | 0 | 35 | 39 | 4 | 1.03 | 3.8 |

includes | 35 | 36 | 1 | 2.50 | 1.0 | |||||

(0.4%Li2O cut-off grade, minimum 1m thickness, up to 2m internal dilution)

Sample analyses were carried by SGS Randfontein (GE_ICP90A50 and GE_FUZ90A50). Cross check analyses were carried out by MSA Laboratories, Vancouver (PER-700).

The drilled pegmatite averages 20m in thickness and dips at 5 degrees towards the north west. A continuous sheet of coarse spodumene mineralisation of up to 11m thick is developed towards the upper contact of the pegmatite and mafic country rocks.

On going exploration is underway to locate additional pegmatites in the immediate vicinity of this target and further to the south where extensive exposures of pegmatites have been mapped in Target Area 2.

Exploration Target Map

Thor/Newstar has also secured additional tenure over this area in a number of joint venture agreements together with wholly owned exploration permits. Further to the west additional exploration tenure has been obtained through the granting of a large exploration permit (EL42245) to the north east together securing additional ground under an agreement with SCT Mining & Exploration Ltd.

The ongoing drilling program has been extended to test all the mapped pegmatites with results expected to be announced by the Group in Q4 2023.

Senegal

Introduction

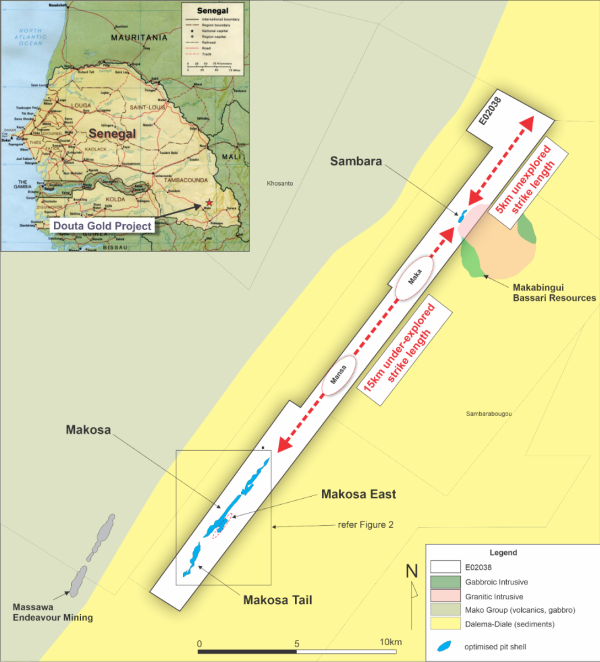

The Douta Gold Project is a gold exploration permit E02038, located within the Kéniéba inlier, eastern Senegal. The northeast-trending license has an area of 58 km2. Thor, through its wholly owned subsidiary African Star Resources Incorporated (“African Star”), has a 70% economic interest in partnership with the permit holder International Mining Company SARL (“IMC”). IMC has a 30% free carried interest in its development until the announcement by Thor of a Probable Reserve.

The Douta licence Is strategically positioned 4km east of Massawa North and Massawa Central deposits, which form part of the world-class Sabadola-Massawa Project owned by Endeavour Mining. The Makabingui deposit, belonging to Bassari Resources Ltd, is immediately located east of the northern portion of E02038 (Figure 2.5).

Drilling Results

Drilling has been focussed in the following areas:

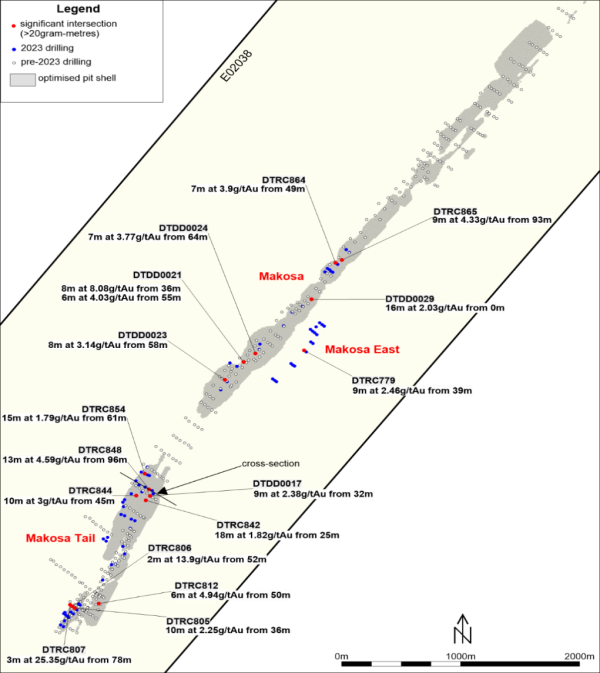

- Resource Upgrade: Makosa and Makosa Tail, Makosa East

- Metallurgical Sampling Makosa and Makosa Tail

- Exploration: Sambara area

Potential Resource Upgrade

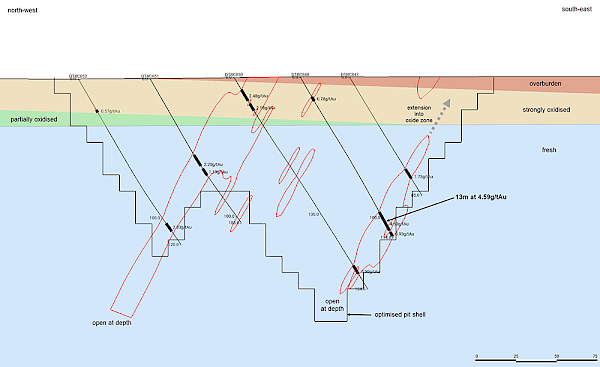

In April 2023 Thor commenced a program of infill RC drilling with the objective of upgrading the inferred portions of the resource that fall within the optimised pit shell, to indicated classification. At Makosa, zones of gold mineralisation are developed either within a sheared gabbro intrusive or within a steep north-westerly dipping sequence of meta-sedimentary rocks that are in close proximity to the gabbro. Higher grade zones or shoots are suspected to occur along east-west oriented structures that cut across the main north-east trend of the mineralisation.

The significant intersections from this program are listed in table below. Drill samples were analysed by ALS Laboratories in Mali using the AA26 fire assay method (50 gram charge).

Douta Project Significant Results (>20 gram-metres: grade*true width)

Prospect | Hole ID | Easting | Northing | Depth | Dip | From (m) | To (m) | Interval (m) | Grade (g/tAu) | True Width (m) |

|---|---|---|---|---|---|---|---|---|---|---|

Makosa Tail | DTDD0017 | 174590 | 1434805 | 45.2 | -50 | 32 | 41 | 9 | 2.38 | 2.4 |

Makosa | DTDD0021 | 175377 | 1436071 | 90.2 | -50 | 36 | 44 | 8 | 8.08 | 7.2 |

Makosa | DTDD0021 | 175377 | 1436071 | 90.2 | -50 | 55 | 61 | 6 | 4.03 | 11.7 |

Makosa | DTDD0023 | 175219 | 1435902 | 70.4 | -50 | 58 | 66 | 8 | 3.14 | 7.2 |

Makosa | DTDD0024 | 175477 | 1436151 | 95.4 | -50 | 64 | 71 | 7 | 3.77 | 14.4 |

Makosa | DTDD0029 | 175949 | 1436665 | 20 | -50 | 0 | 16 | 16 | 2.03 | 14.4 |

Makosa East | DTRC779 | 175885 | 1436181 | 54 | -60 | 39 | 48 | 9 | 2.46 | 8.0 |

Makosa Tail | DTRC805 | 173959 | 1433743 | 50 | -60 | 36 | 46 | 10 | 2.25 | 4.8 |

Makosa Tail | DTRC806 | 173939 | 1433758 | 74 | -60 | 52 | 54 | 2 | 13.90 | 1.6 |

Makosa Tail | DTRC807 | 173920 | 1433773 | 100 | -60 | 78 | 81 | 3 | 25.35 | 5.6 |

Makosa Tail | DTRC812 | 174161 | 1433787 | 90 | -60 | 50 | 56 | 6 | 4.94 | 13.5 |

Makosa Tail | DTRC842 | 174556 | 1434762 | 69 | -60 | 25 | 43 | 18 | 1.82 | 6.3 |

Makosa Tail | DTRC844 | 174476 | 1434806 | 69 | -60 | 45 | 55 | 10 | 3.00 | 7.2 |

Makosa Tail | DTRC848 | 174583 | 1434868 | 114 | -60 | 96 | 109 | 13 | 4.59 | 5.4 |

Makosa Tail | DTRC854 | 174545 | 1435016 | 107 | -60 | 61 | 76 | 15 | 1.79 | 9.0 |

Makosa | DTRC864 | 176149 | 1437011 | 90 | -60 | 49 | 56 | 7 | 3.90 | 8.1 |

Makosa | DTRC865 | 176203 | 1437037 | 72 | -60 | 93 | 102 | 9 | 4.33 | 8.1 |

(0.5g/tAu lower cut off; minimum width 2m with 2m max internal waste)

The drill results demonstrate the continuity of gold mineralisation both along strike and down dip. Several higher-grade intersections were obtained including 2m grading 13.90g/tAu g/tAu in drillhole DTRC806, 3m grading 25.35g/tAu in DTRC807 and 6m grading 4.94g/tAu in DTRC812.

In addition to upgrading the resource classification, intersections such as these will likely have a positive effect in locally elevating the average resource grade.

With the exploration fieldwork complete, the Group aims to announce an updated resource in Q4 2023. The preliminary feasibility study workstreams are ongoing with a preliminary feasibility study expected to be completed in Q1 2024.

Douta Project Location Map

Metallurgical Sampling

A total of 22 diamond holes were completed to obtain representative samples, from both Makosa and Makosa Tail to undergo detailed metallurgical test work. Several of these holes twinned existing historic RC holes and returned results that are consistent with the earlier grades and thicknesses. Independent Metallurgical Operations (IMO) are undertaking the test work program in Perth, Western Australia.

Exploration At the Sambara prospect several RC holes were drilled to test both the extremities of the Sambara deposit and a soil geochemical anomaly that was located in the northwestern part of the exploration licence. Best results include 5m grading 1.35g/tAu in drillhole DTRC726 and 4m grading 1.43g/tAu in DTRC729. Further testing along the prospective strike length is planned for the remainder of 2023.

Drillhole location map showing Significant Results (>20gram-metres)

Makosa Tail Cross-section Showing Grade Continuity on In-fill Drill-section